Week 2: CBD Pedestrian Example for ARIMA Models

1 Dataset

library(tidyverse) # read_csv

library(fpp3)

library(ggplot2)

library(dplyr)

library(tsibble)

library(fable)- Here, index

- 1:2208: training

- 2209:2376: testing

load("datasets/melb_sel.Rdata")

head(melb_sel)

## For the whole dataset

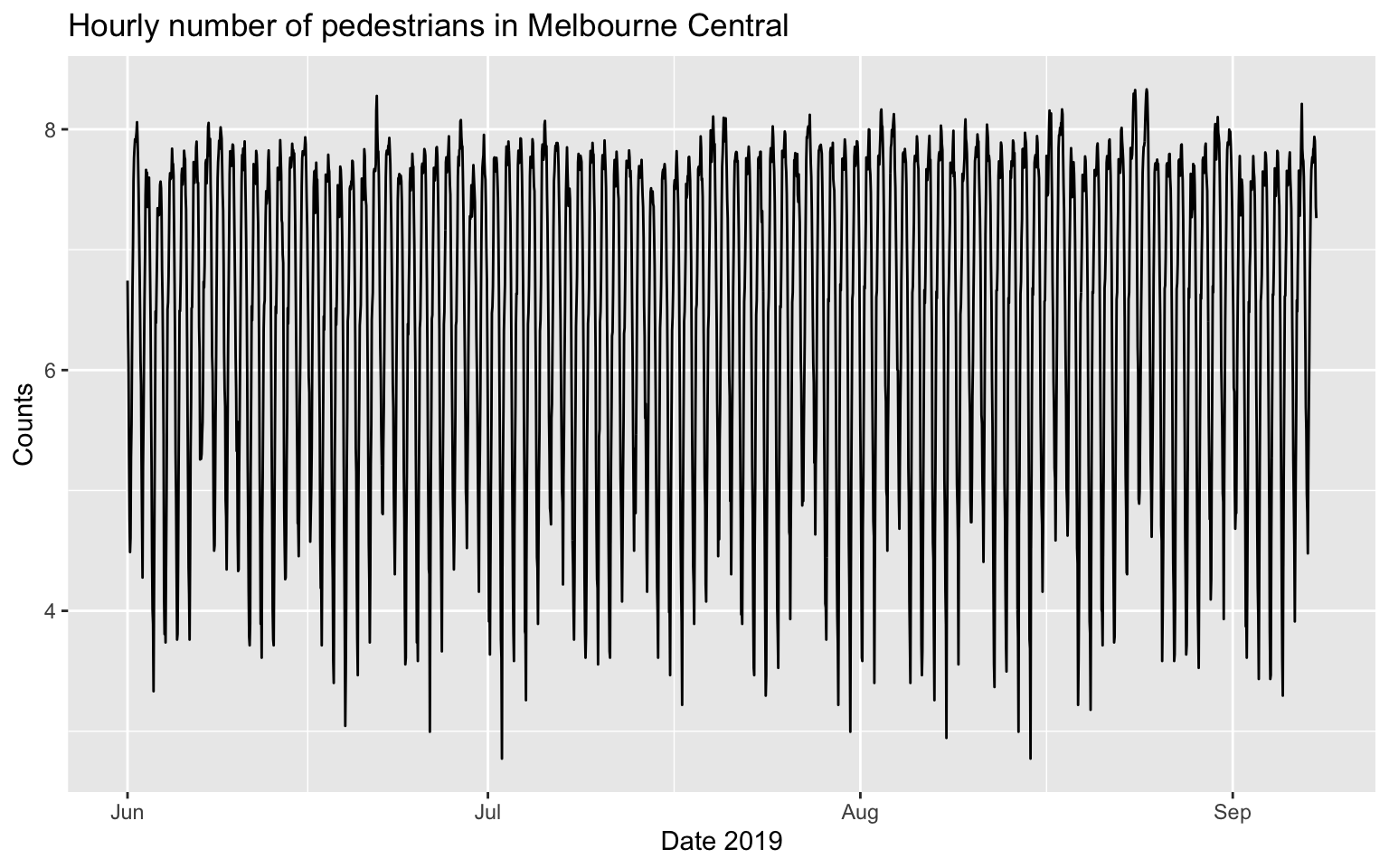

autoplot(melb_sel, counts) +

labs(x = 'Date 2019', y = 'Counts', title = 'Hourly number of pedestrians in Melbourne Central')

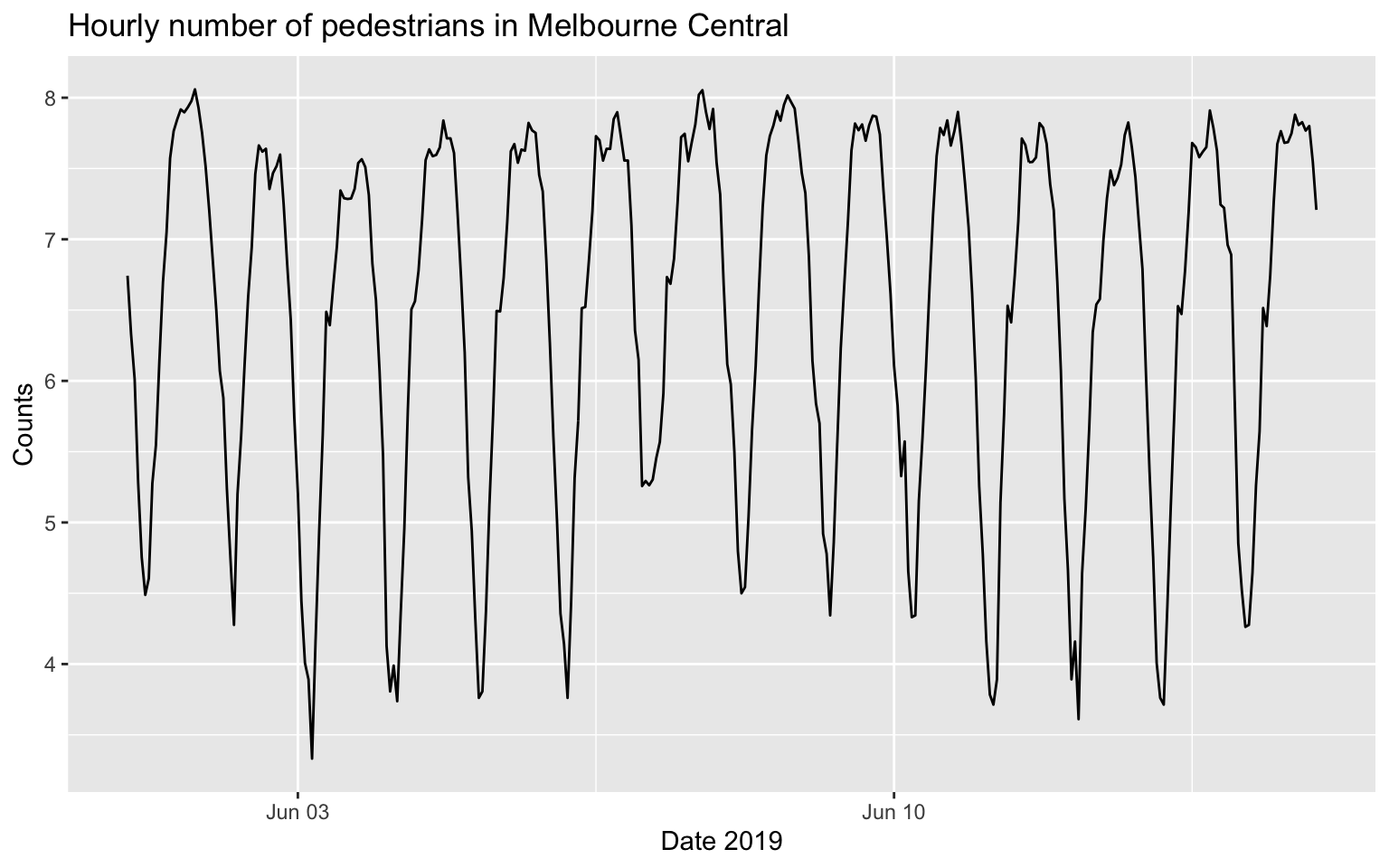

## For the first two weeks

autoplot(melb_sel[1:336, ], counts) +

labs(x = 'Date 2019', y = 'Counts', title = 'Hourly number of pedestrians in Melbourne Central')

## # A tsibble: 6 x 2 [1h] <UTC>

## date counts

## <dttm> <dbl>

## 1 2019-06-01 00:00:00 6.74

## 2 2019-06-01 01:00:00 6.33

## 3 2019-06-01 02:00:00 6.01

## 4 2019-06-01 03:00:00 5.28

## 5 2019-06-01 04:00:00 4.75

## 6 2019-06-01 05:00:00 4.492 ARIMA

First, we test whether the dataset is stationary. As you can see, KPSS fails to reject null hypothesis, meaning the dataset is stationary.

melb_sel[1:2208, ] %>% features(counts, unitroot_kpss)## # A tibble: 1 × 2

## kpss_stat kpss_pvalue

## <dbl> <dbl>

## 1 0.0677 0.1melb_sel[1:2208, ] %>% features(counts, unitroot_ndiffs)## # A tibble: 1 × 1

## ndiffs

## <int>

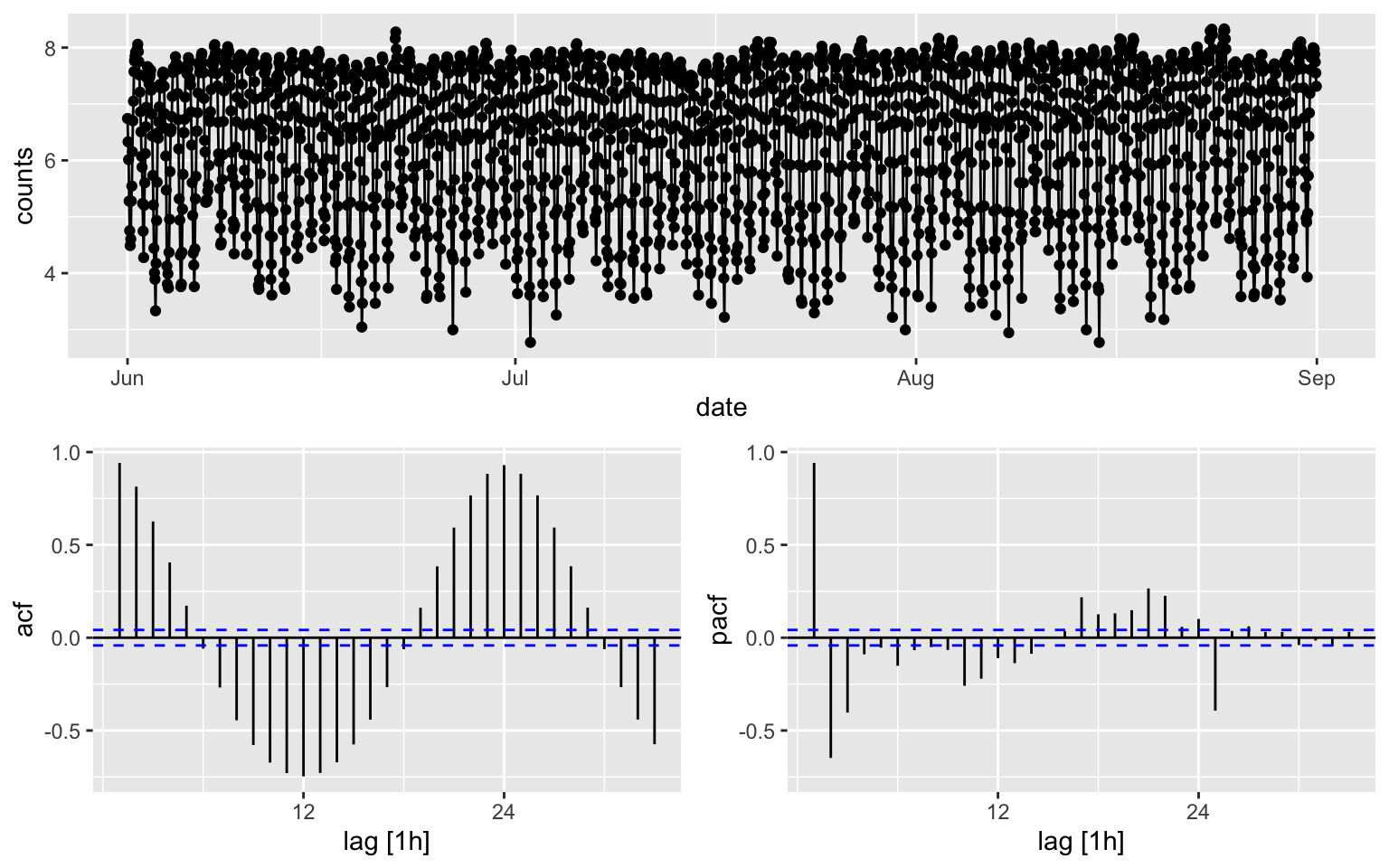

## 1 0melb_sel[1:2208, ] %>% gg_tsdisplay(plot_type = "partial", y = counts) ``The p-value is reported as 0.01 if it is less than 0.01, and as 0.1 if

it is greater than 0.1.”

``The p-value is reported as 0.01 if it is less than 0.01, and as 0.1 if

it is greater than 0.1.”

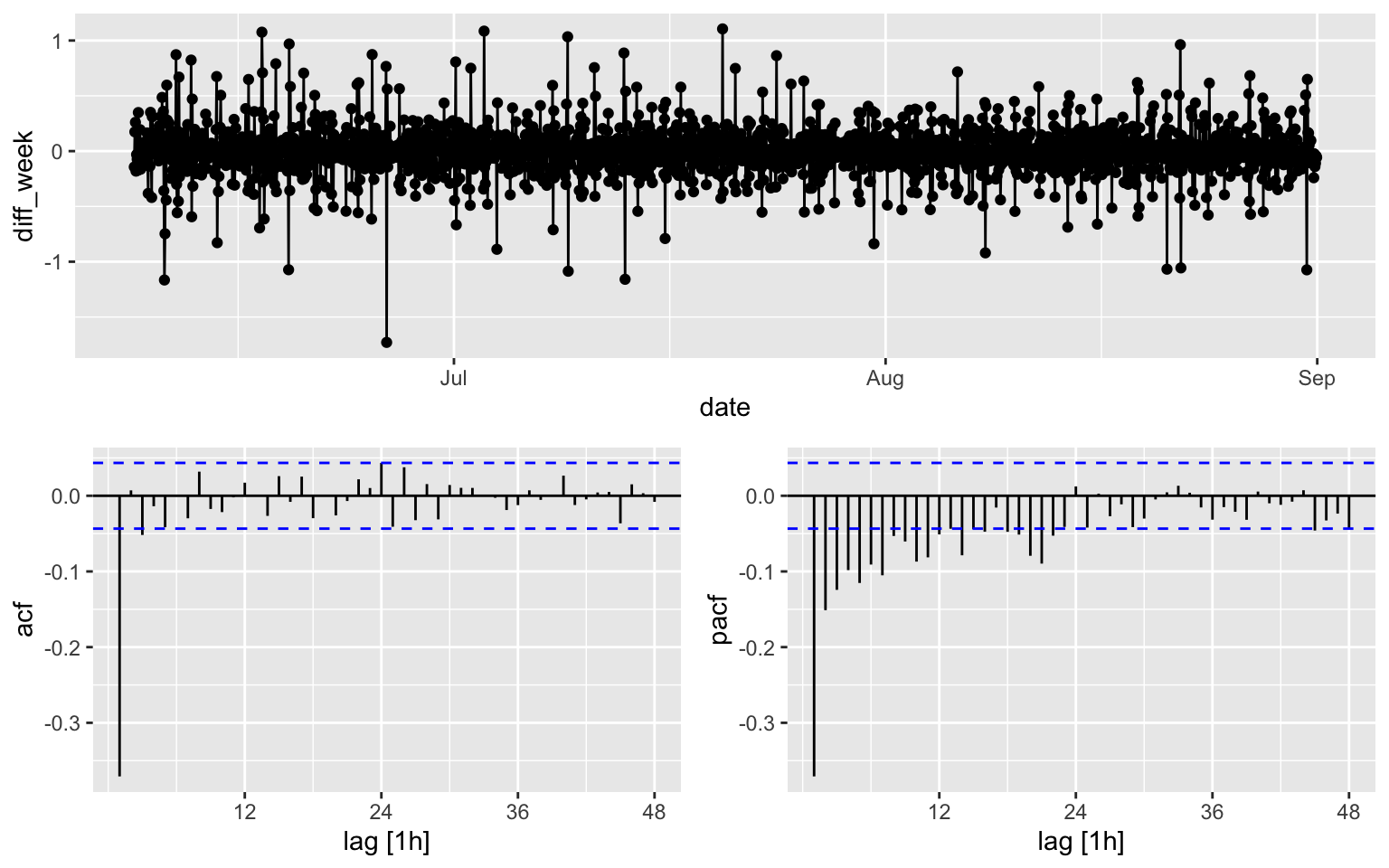

Although the counts is stationary, I will still consider a weekly difference + a lag 1 difference.

# To determine the seasonal differencing.

melb_sel[1:2208, ] %>% features(counts, unitroot_nsdiffs,.period = 168) # m = 168 for a week. Try a random number and see what happens## # A tibble: 1 × 1

## nsdiffs

## <int>

## 1 1melb_sel$diff_week <- difference(melb_sel$counts, lag=168) %>% difference(lag = 1)

melb_sel[170:2208, ] %>% features(diff_week, unitroot_kpss)## # A tibble: 1 × 2

## kpss_stat kpss_pvalue

## <dbl> <dbl>

## 1 0.00990 0.1melb_sel[170:2208, ] %>%

gg_tsdisplay(diff_week, plot_type='partial', lag = 48)

It is hard to see which ARIMA model shall be used for the counts, while for the diff_week, a possible candidates is MA(3).

- I will build three model.

- Model 1: automatic procedure for the diff_week

- Model 2: MA(3) for the diff_week

- Model 3: automatic procedure for the counts

2.1 Model 1

fit1 <- melb_sel[170:2208, ] %>%

model(ARIMA(diff_week ~ PDQ(0,0,0), stepwise = TRUE))

report(fit1)## Series: diff_week

## Model: ARIMA(2,0,1)

##

## Coefficients:

## ar1 ar2 ma1

## 0.4163 0.1600 -0.9743

## s.e. 0.0230 0.0229 0.0066

##

## sigma^2 estimated as 0.03655: log likelihood=481.18

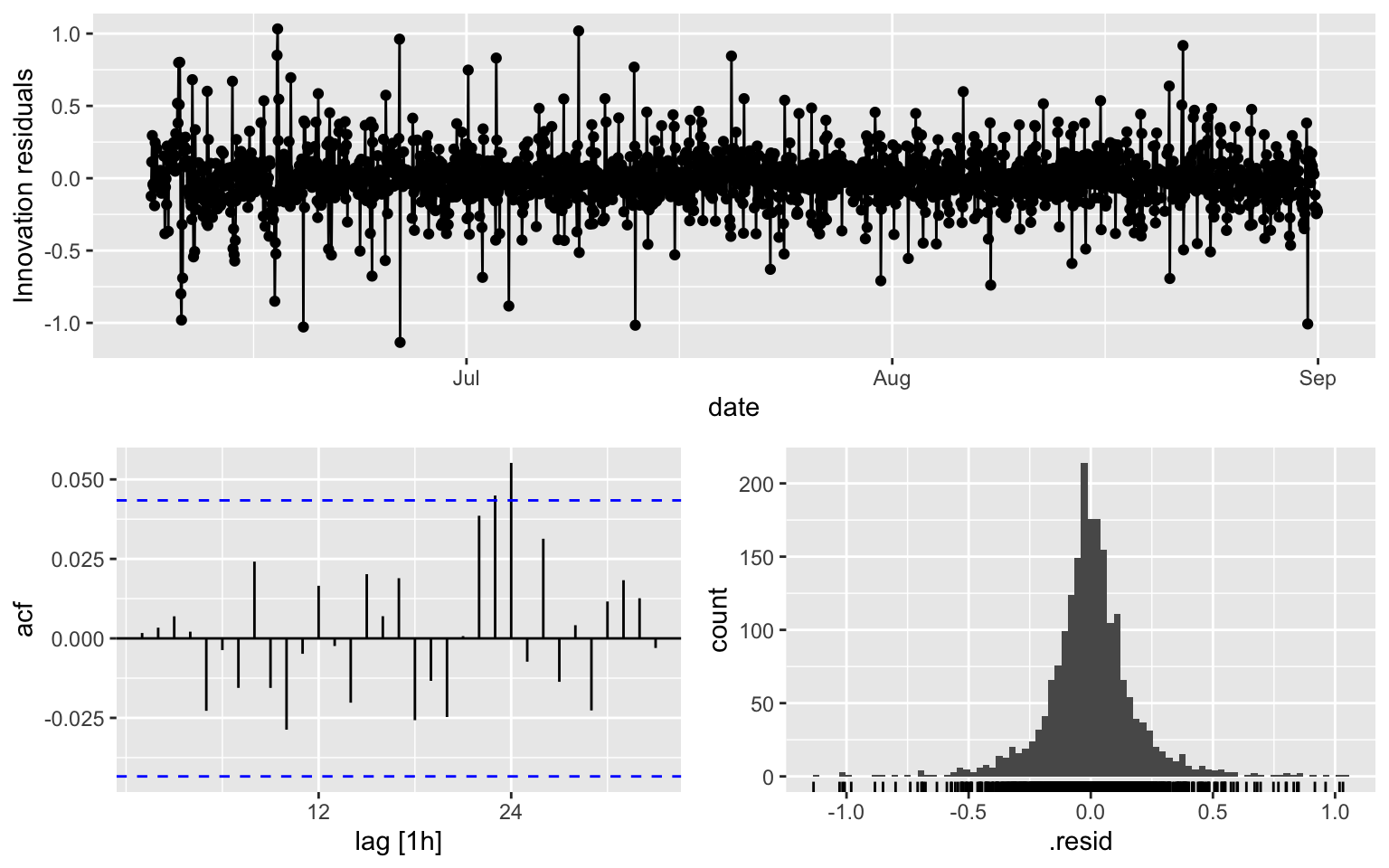

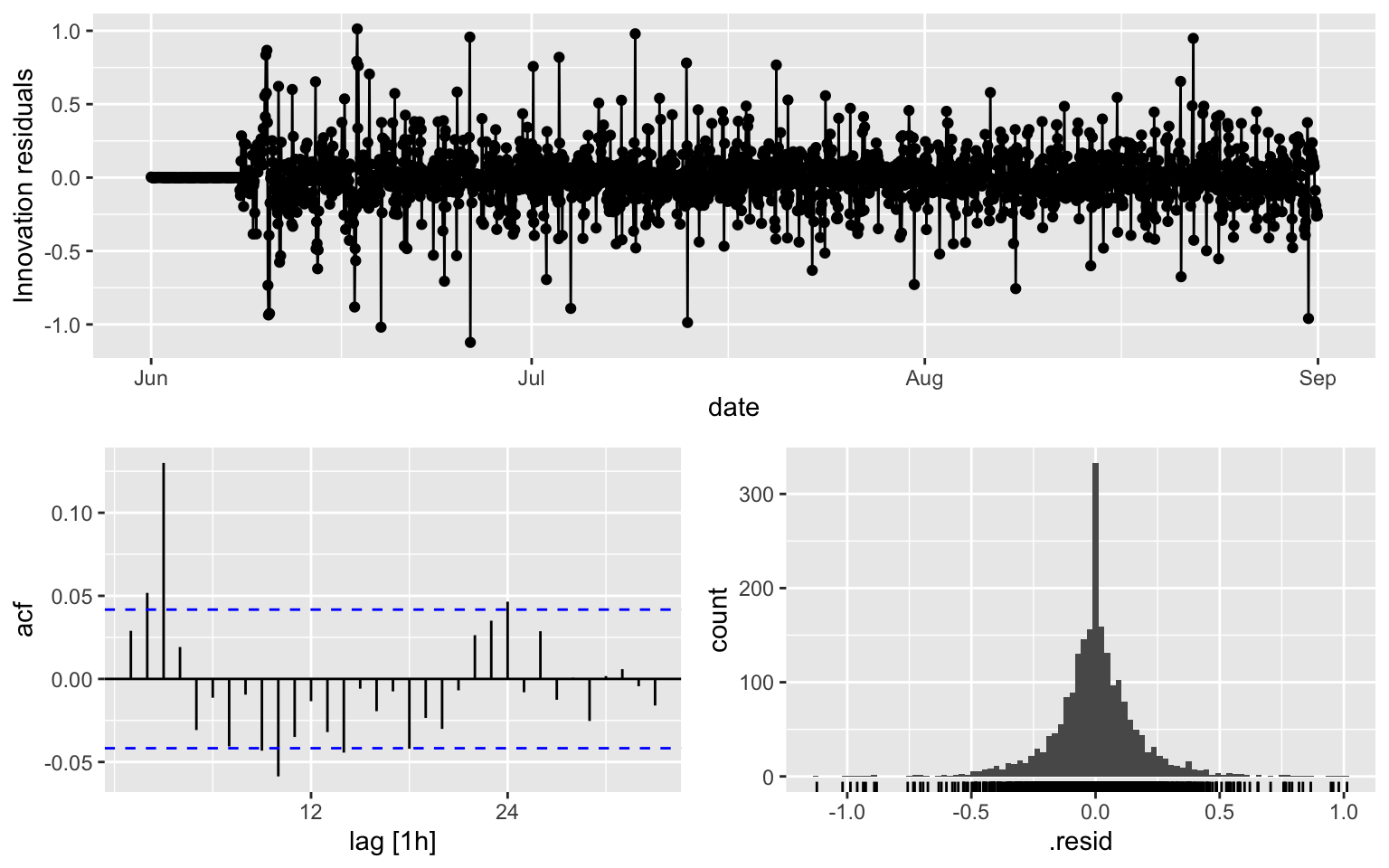

## AIC=-954.35 AICc=-954.33 BIC=-931.87ACF is over the threshold limits at lag = 24.

fit1 %>% gg_tsresiduals()

augment(fit1) %>% features(.innov, ljung_box, lag = 10, dof = 3)## # A tibble: 1 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 ARIMA(diff_week ~ PDQ(0, 0, 0), stepwise = TRUE) 5.10 0.6472.2 Model 2

fit2 <- melb_sel[170:2208, ] %>%

model(ARIMA(diff_week ~ pdq(0,0,3) + PDQ(0,0,0)))

report(fit2)## Series: diff_week

## Model: ARIMA(0,0,3)

##

## Coefficients:

## ma1 ma2 ma3

## -0.5675 -0.1087 -0.2156

## s.e. 0.0221 0.0278 0.0213

##

## sigma^2 estimated as 0.03765: log likelihood=451.06

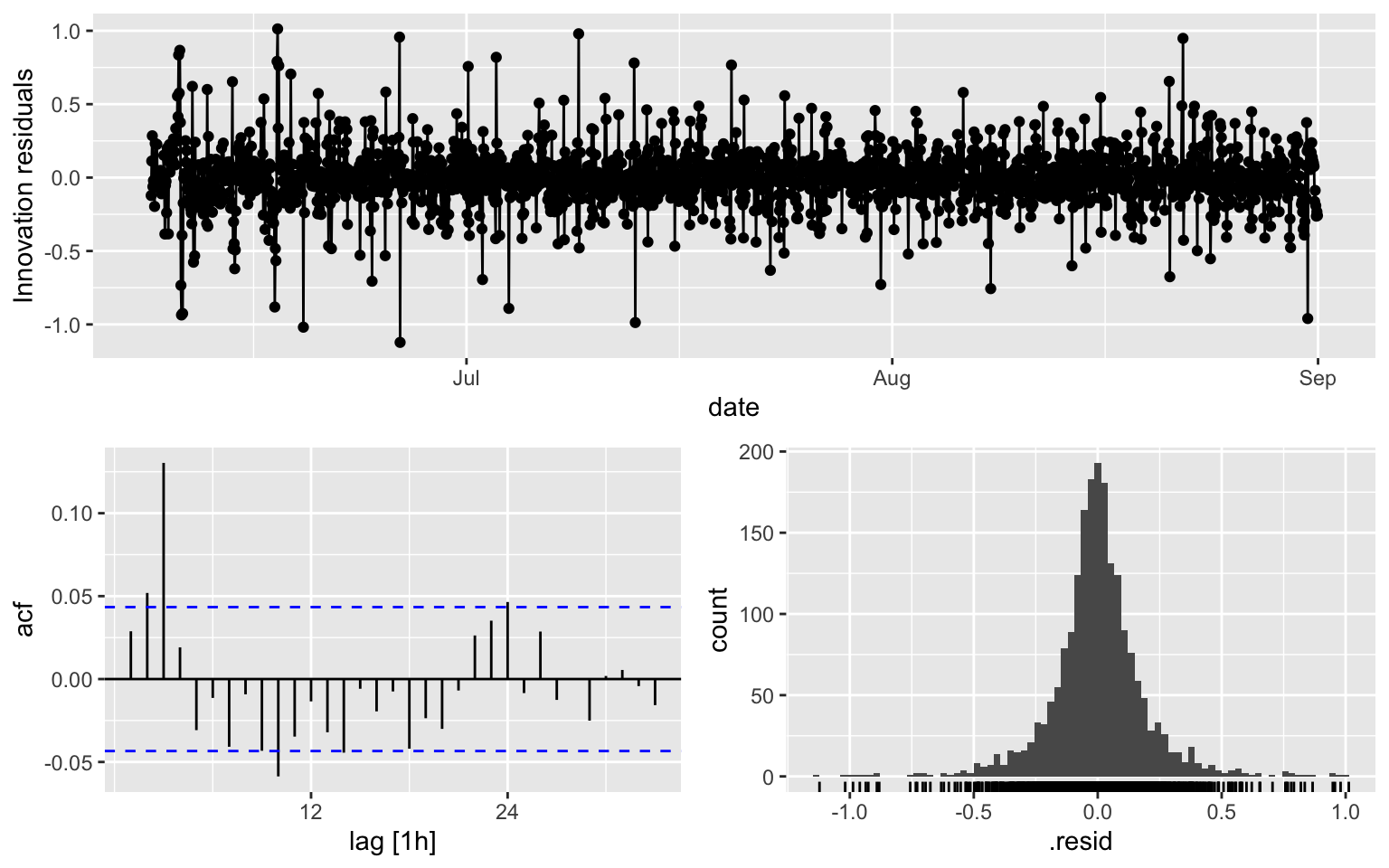

## AIC=-894.11 AICc=-894.09 BIC=-871.63ACF is over the thereshold at multiple lags

fit2 %>% gg_tsresiduals()

augment(fit2) %>% features(.innov, ljung_box, lag = 10, dof = 3)## # A tibble: 1 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 ARIMA(diff_week ~ pdq(0, 0, 3) + PDQ(0, 0, 0)) 59.4 2.03e-102.3 Model 3

fit3 <- melb_sel[1:2208,] %>%

model(ARIMA(counts ~ PDQ(0,0,0), stepwise = TRUE))

report(fit3)## Series: counts

## Model: ARIMA(2,0,3) w/ mean

##

## Coefficients:

## ar1 ar2 ma1 ma2 ma3 constant

## 1.8728 -0.9432 -0.6946 0.1193 -0.2145 0.4592

## s.e. 0.0076 0.0075 0.0212 0.0271 0.0220 0.0013

##

## sigma^2 estimated as 0.08785: log likelihood=-447.11

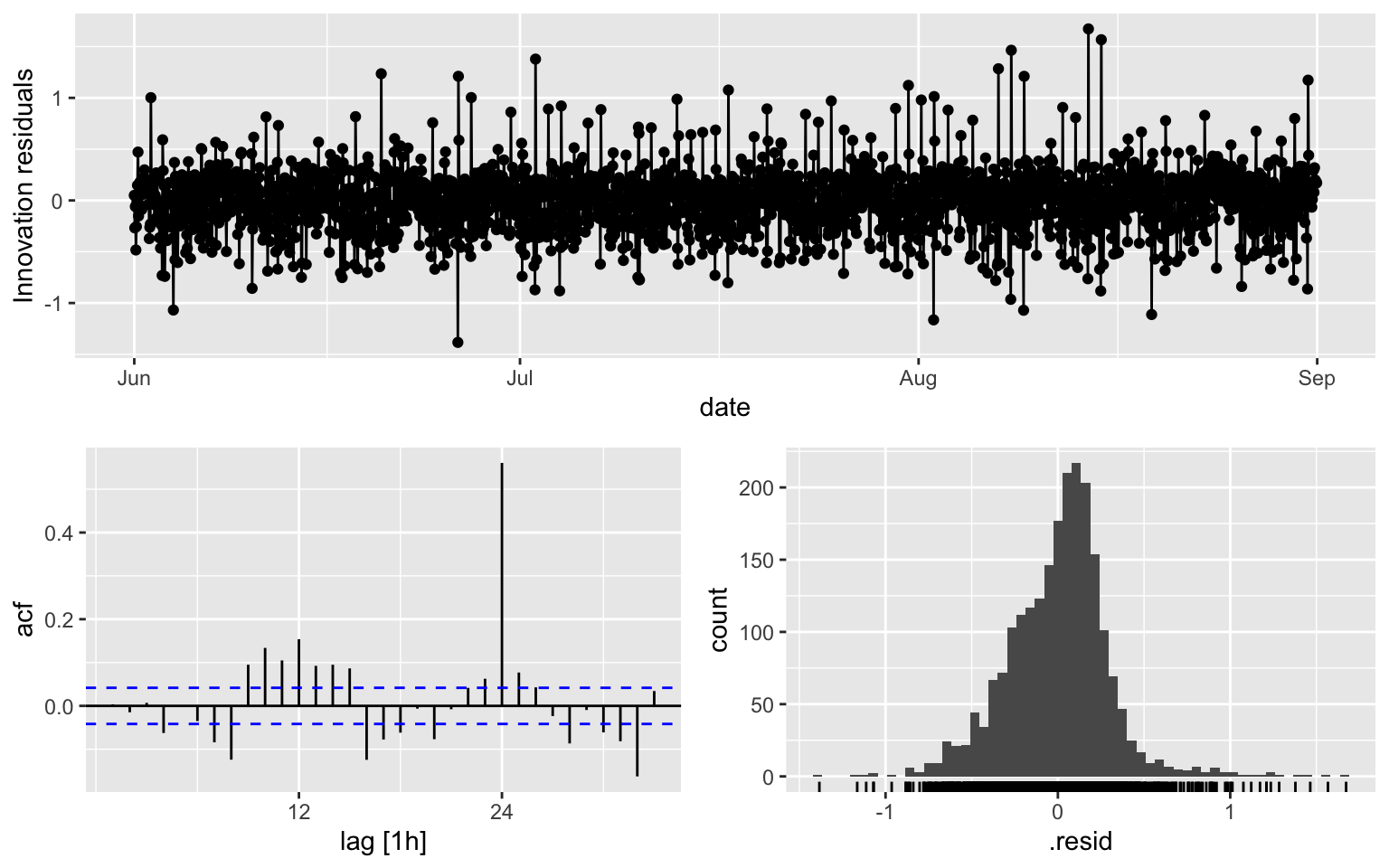

## AIC=908.21 AICc=908.26 BIC=948.11ACF is over the thereshold at multiple lags

fit3 %>% gg_tsresiduals()

augment(fit3) %>% features(.innov, ljung_box, lag = 10, dof = 5)## # A tibble: 1 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 ARIMA(counts ~ PDQ(0, 0, 0), stepwise = TRUE) 122. 0- Model 1 appears to be the best, although there are still some

problems. Here is my personal opinion

- In the real-world dataset, the result is often not as good as the example in the book (e.g. Central African Republic exports in Cp 9.7)

- lag = 24 means some daily seasonality: maybe fixable with another difference with (lag = 24).

3 Seasonal ARIMA

- I will consider the following model

- Model 4: (2,1,1)(0,1,0)\(_{168}\) for the counts, it is the same model as Model 1

- Model 5: (0,1,3)(0,1,0)\(_{168}\) for the counts, it is the same model as Model 2

- Model 6: automatic selection for ( ,1, )(,1, )\(_{168}\) for the counts

3.1 Model 4

\(\phi\)’s and \(\theta\)s are the same as Model 1, but AIC, BIC and AICc are different.

fit4 <- melb_sel[1:2208, ] %>%

model(ARIMA(counts ~ pdq(2,1,1) + PDQ(0,1,0, period = 168)))

report(fit4)## Series: counts

## Model: ARIMA(2,1,1)(0,1,0)[168]

##

## Coefficients:

## ar1 ar2 ma1

## 0.4163 0.1600 -0.9743

## s.e. 0.0230 0.0229 0.0066

##

## sigma^2 estimated as 0.03655: log likelihood=477.25

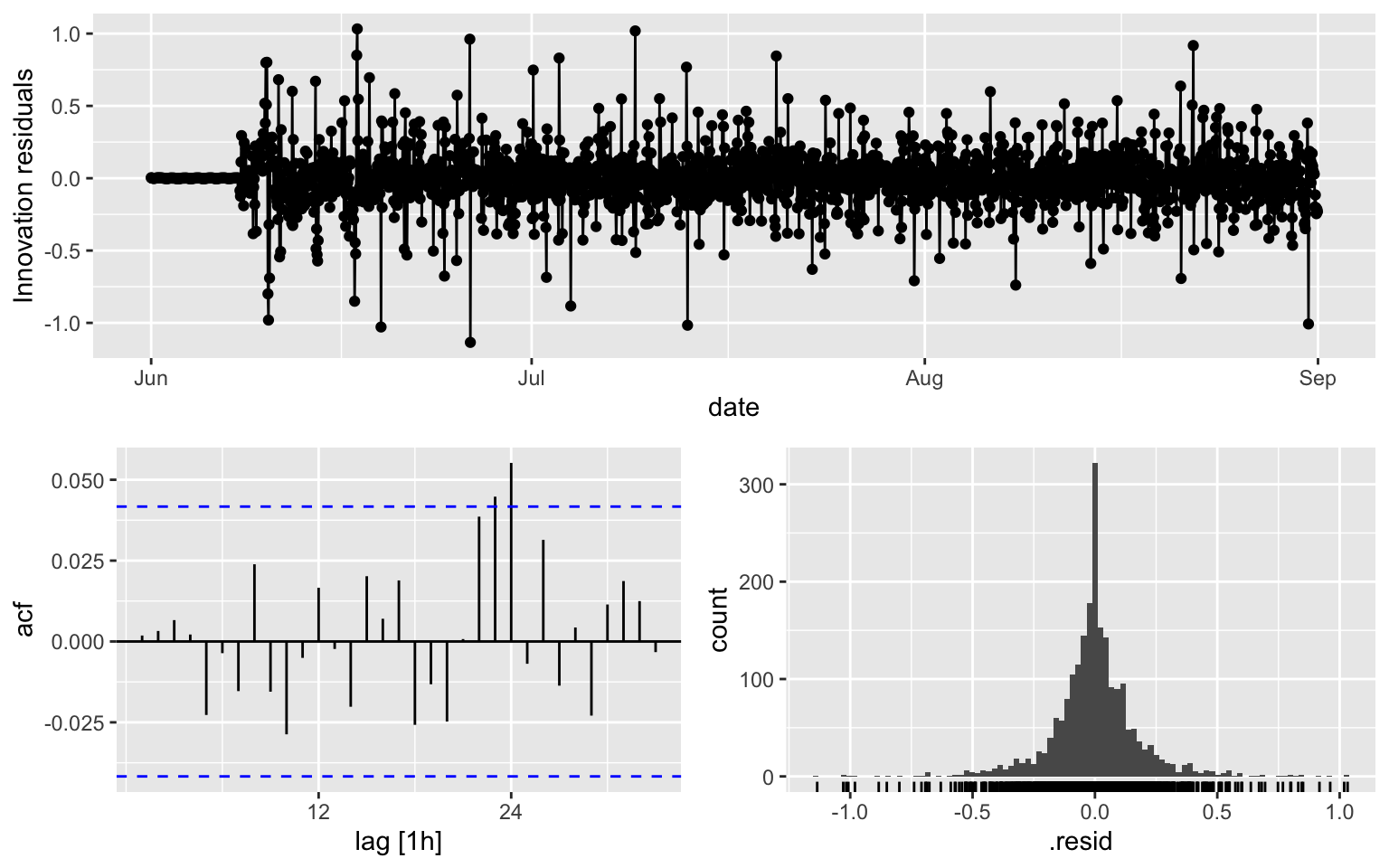

## AIC=-946.5 AICc=-946.48 BIC=-924.02fit4 %>% gg_tsresiduals()

augment(fit4) %>% features(.innov, ljung_box, lag = 10, dof = 3)## # A tibble: 1 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 ARIMA(counts ~ pdq(2, 1, 1) + PDQ(0, 1, 0, period = 168)) 5.46 0.6043.2 Model 5

fit5 <- melb_sel[1:2208, ] %>%

model(ARIMA(counts ~ pdq(0,1,3) + PDQ(0,1,0, period = 168)))

report(fit5)## Series: counts

## Model: ARIMA(0,1,3)(0,1,0)[168]

##

## Coefficients:

## ma1 ma2 ma3

## -0.5675 -0.1087 -0.2156

## s.e. 0.0221 0.0278 0.0213

##

## sigma^2 estimated as 0.03765: log likelihood=447.13

## AIC=-886.26 AICc=-886.24 BIC=-863.78fit5 %>% gg_tsresiduals()

augment(fit5) %>% features(.innov, ljung_box, lag = 10, dof = 3)## # A tibble: 1 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 ARIMA(counts ~ pdq(0, 1, 3) + PDQ(0, 1, 0, period = 168)) 64.0 2.37e-113.3 Model 6

## The following codes take quite a while to run

#fit6 <- melb_sel[1:2208, ] %>%

# model(ARIMA(counts ~ pdq(,1,) + PDQ(,1,, period = 168)))

#report(fit6)

#fit6 %>% gg_tsresiduals()

#augment(fit6) %>% features(.innov, ljung_box, lag = 10, dof = 3)4 Forecasting

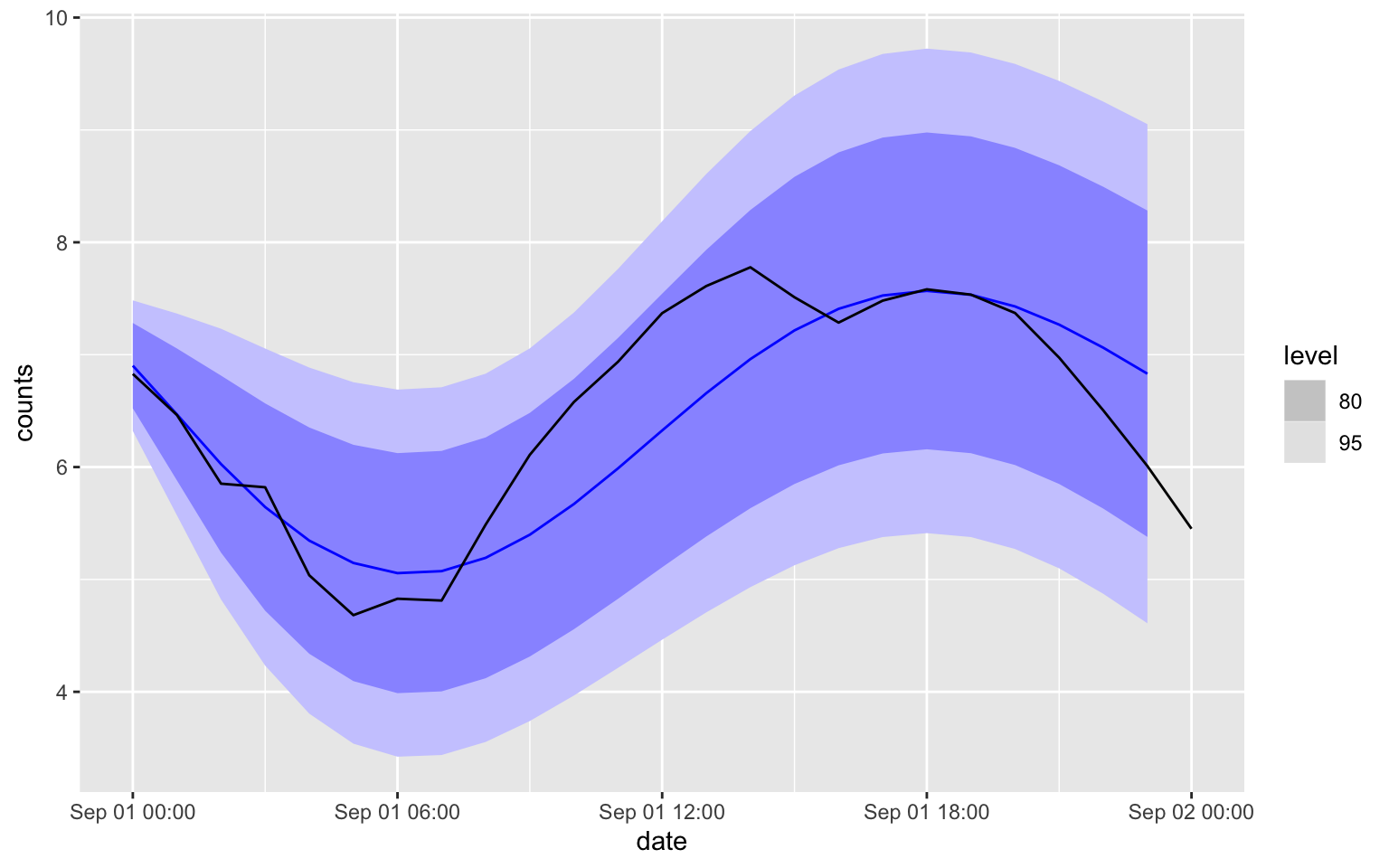

There is a function in the package to do the forecasting

forecast(fit3, h = 24) %>%

autoplot(melb_sel[2209:2233,])

I will not recommend you to use Model 1/Model 2 for the forecasting the counts, since it is difficult to transform the prediction interval. Instead, using the corresponding seasonal-ARIMA model if you can.

MSE

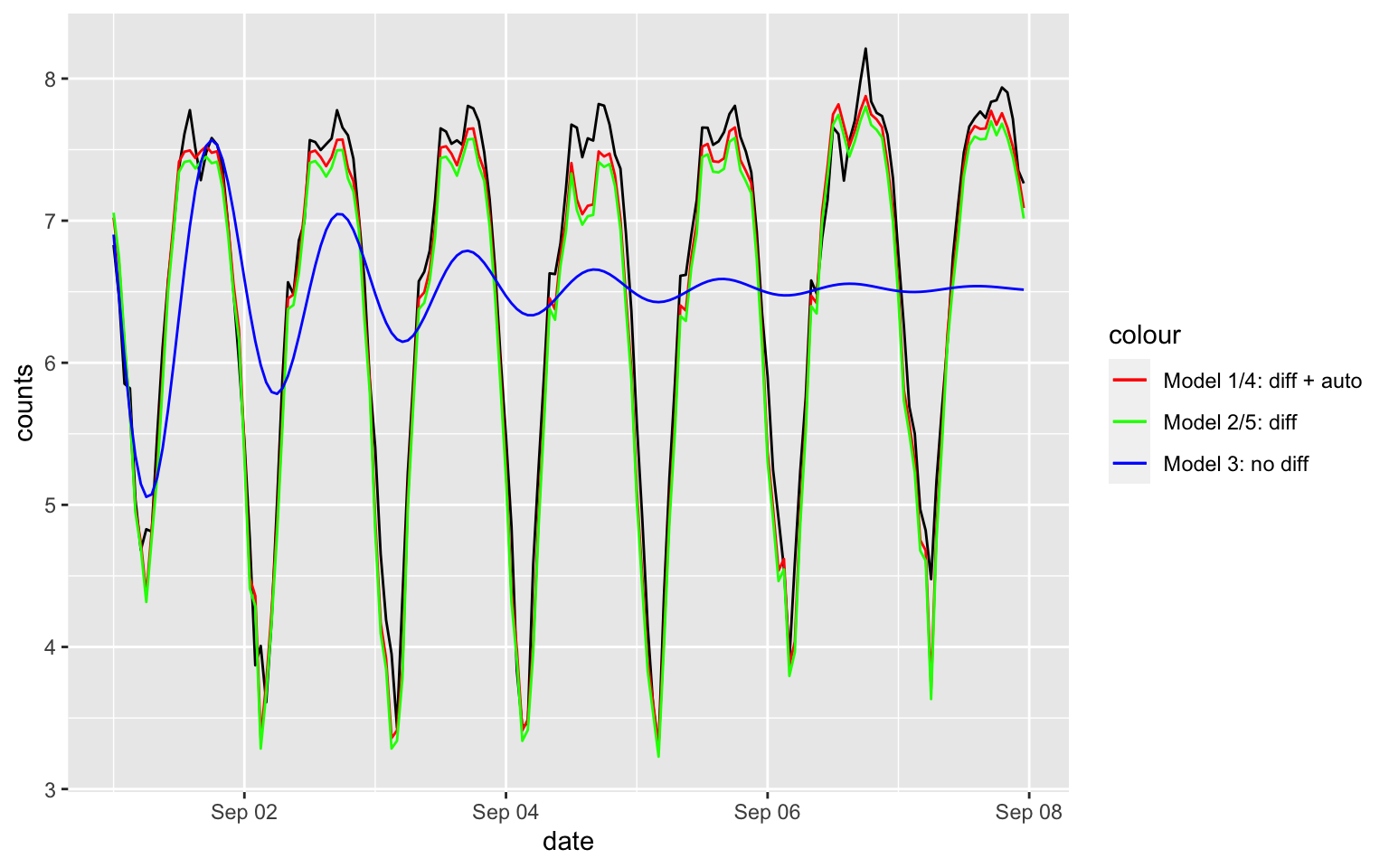

H = 24*7

idx = 2209:(2208 + H)

tmp3 = forecast(fit3, h = H)

tmp4 = forecast(fit4, h = H)

tmp5 = forecast(fit5, h = H)

#tmp6 = forecast(fit6, h = H)

MSE3 = mean((tmp3$.mean - melb_sel$counts[idx])^2)

MSE4 = mean((tmp4$.mean - melb_sel$counts[idx])^2)

MSE5 = mean((tmp5$.mean - melb_sel$counts[idx])^2)

#MSE6 = mean((tmp6$.mean - melb_sel$counts[idx])^2)

c(MSE3, MSE4, MSE5)## [1] 1.32308207 0.05927944 0.08740256The plots

melb_sel$tf3 = NA

melb_sel$tf4 = NA

melb_sel$tf5 = NA

melb_sel$tf3[idx] = tmp3$.mean

melb_sel$tf4[idx] = tmp4$.mean

melb_sel$tf5[idx] = tmp5$.mean

ggplot(data = melb_sel[idx, ], aes(x = date, y = counts)) + geom_line() +

geom_line(aes(x = date, y = tf4, color = "Model 1/4: diff + auto")) +

geom_line(aes(x = date, y = tf5, color = "Model 2/5: diff")) +

geom_line(aes(x = date, y = tf3, color = "Model 3: no diff")) +

scale_color_manual(name = "colour", values = c("Model 1/4: diff + auto" = "red", "Model 2/5: diff" = "green", "Model 3: no diff" = "blue"))

Also for H = 9

H = 9

idx = 2209:(2208 + H)

tmp3 = forecast(fit3, h = H)

tmp4 = forecast(fit4, h = H)

tmp5 = forecast(fit5, h = H)

#tmp6 = forecast(fit6, h = H)

MSE3 = mean((tmp3$.mean - melb_sel$counts[idx])^2)

MSE4 = mean((tmp4$.mean - melb_sel$counts[idx])^2)

MSE5 = mean((tmp5$.mean - melb_sel$counts[idx])^2)

#MSE6 = mean((tmp6$.mean - melb_sel$counts[idx])^2)

c(MSE3, MSE4, MSE5)## [1] 0.06510162 0.05137324 0.06741480melb_sel$counts[idx]## [1] 6.828712 6.463029 5.852202 5.820083 5.036953 4.682131 4.828314 4.812184

## [9] 5.488938tmp4$.mean## [1] 7.021772 6.699546 6.123637 5.650102 4.974128 4.733842 4.369324 4.823901

## [9] 5.2672485 Automatic Procedure

fitX <- melb_sel[1:2208, ] %>%

model(ARIMA(counts ~ pdq(,1,) + PDQ(0,1,0, period = 168)))

report(fitX)## Series: counts

## Model: ARIMA(2,1,1)(0,1,0)[168]

##

## Coefficients:

## ar1 ar2 ma1

## 0.4163 0.1600 -0.9743

## s.e. 0.0230 0.0229 0.0066

##

## sigma^2 estimated as 0.03655: log likelihood=477.25

## AIC=-946.5 AICc=-946.48 BIC=-924.02fitY <- melb_sel[1:2208, ] %>%

model(ARIMA(counts ~ pdq(,0,) + PDQ(0,1,0, period = 168)))

report(fitY)## Series: counts

## Model: ARIMA(3,0,1)(0,1,0)[168]

##

## Coefficients:

## ar1 ar2 ar3 ma1

## 1.3945 -0.2491 -0.1534 -0.9568

## s.e. 0.0266 0.0377 0.0230 0.0145

##

## sigma^2 estimated as 0.03637: log likelihood=487.43

## AIC=-964.85 AICc=-964.83 BIC=-936.756 Exercise

Fit Model 4 with the intercept, see whether the forecasting performance improves.